Mvelopes review: A solid system for basic budgeting - martinbegroway

At a Glance

Expert's Rating

Pros

- Imports and categorizes bank transactions

- Uses simple and effective envelope budgeting method

- Generates an align of personal financial reports

Cons

- User interface is dated and john be frustrating to learn

- Doesn't support brokerage accounts

Our Verdict

Mvelopes is a good tool improved on sound budgeting principles, but its old-civilis user interface needs to go.

Mvelopes mines the same tried-and-honorable envelopes budgeting system as You Call for a Budget and Dave Ramsey's Every Dollar, expressly telegraphing the fact in its malapropic cite. The app doesn't look as polished as some of its competitors' offerings, but its system is sound and easy to grasp even if you've never created a budget before.

Banknote: This review is theatrical role of our roundup of the best budgeting software. Go there for details about competing products you said it we tested them.

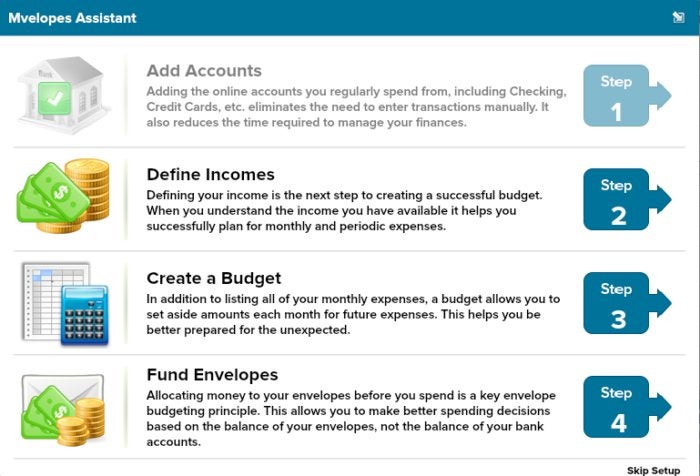

Mvelopes walks you through a four-step setup process of syncing your depository financial institution accounts, defining your income, creating a budget, and funding your envelopes.

Mvelopes by Finicity

Mvelopes by Finicity Adding your various Sir Joseph Banks is easy. Mvelopes displays clickable tiles for fast access to the most popular financial institutions. Happening the off-chance your bank ISN't among them you can search the database for information technology. If your bank isn't supported, Mvelopes provides a Newfound Institution Quest form and promises to respond within two to 4 years.

Michael Ansaldo/IDG

Michael Ansaldo/IDG Setting up Mvelopes is a four-step process and the program guides you through from each one.

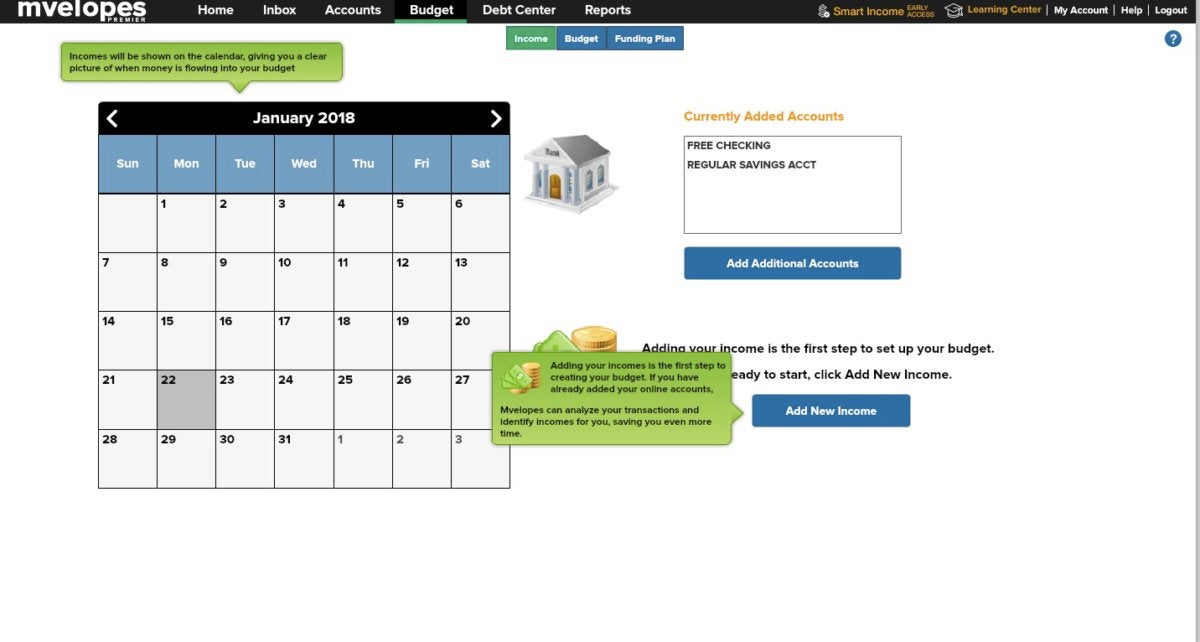

Once your bank accounts are added, Mvelopes scans your transactions for deposits to look into your income. This works advisable if you have a fixed income with a consistent sedimentation quantity, such as when you receive a salary. If you'Ra an time unit wage actor, it may be more knotty. For instance, Mvelopes aright identified my married woman's biweekly deposits as a regular paycheck but couldn't account for the fact that the deposit amounts varied. It arbitrarily grabbed one deposit total—curiously not the virtually recent combined—and populated the biweekly income field therewith number.

Mvelopes earns point for providing a separate input for folks who have variable income, though it requires you to project what you wish make to each one month. As any temp worker OR freelancer tail tell you, even the most careful estimations are frequently derailed by after-hours payments or unexpectedly fallow periods.

With your income entered, you dismiss create your budget. Mvelopes provides a basic template with pre-populated expense, savings, and liberal categories —though you can personalize these—and you simply enter monthly payment amounts for each. There's also a section for irregular expenses like auto and home sustenance and vacations.

Michael Ansaldo/IDG

Michael Ansaldo/IDG Mvelopes helps you get into your income whether you sustain a regular payroll check, receive variable payments, or both.

Once your first budget is created, it's clock to fund your envelopes. You do this by assigning amounts from your Income Cash in on Pool—the total of all your bank account balances—to each budget category, either equally a flat dollar mark amount or a percentage of your available cash. Mvelopes deducts the amounts from whichever paycheck surgery sedimentation amount you've allocated for funding. It also saves all the data as a "funding visibility" so you can easily double the financial backin process adjacent time if you wish.

As Mvelopes imports bank transactions, they are mechanically allotted to budget categories, though you can manually custom-make them. Exceeded category budgets are displayed in red, and you'Ra prompted to refund the envelope. You ass also running an array of reports to track your cash flow, envelope spending, net worth over fourth dimension and opposite trends. Note that spell Mvelopes will Army of the Pure you tie in to brokerage accounts so you can see how they contribute to things like your net worth, you can't admonisher or get by those accounts from the app.

Mvelopes offers troika plans. BASIC gives you the envelopes budgeting system distinct here, on with unrecorded chat support and hebdomadally webinars for $4 a month after a unconstrained 30-day visitation. The Plus plan adds debt reduction tools, united-along-one setup help, towering tier priority support and quarterly checkups with Mvelopes Personal Finance Trainer for $19 a month. The top-level Complete subscription adds customized planning, trainer-guided financial education and monthly session with an Mvelopes Personal Finance Trainer for $59 a month. For all contrive, you posterior get two months free away paying for a year improving-front.

Seat line

Mvelopes is a cubic personal finance tool for home budgeting. Deposit syncing and automatic transaction compartmentalization make information technology impressionable to stick to your gasbag-based plan once you've created your budget. The blink-based user interface looks a trifle dateable and clunky, and finding your way or so the tab-supported layout can be frustrating at first. But those appear like minor quibbles once you fix the hang of it, considering how quickly it can help you control of your spending and saving.

Source: https://www.pcworld.com/article/407854/mvelopes-review.html

Posted by: martinbegroway.blogspot.com

0 Response to "Mvelopes review: A solid system for basic budgeting - martinbegroway"

Post a Comment